MSE TOP-20 Down 3.5%

Khulan M.

October 13, 2025

October 13, 2025

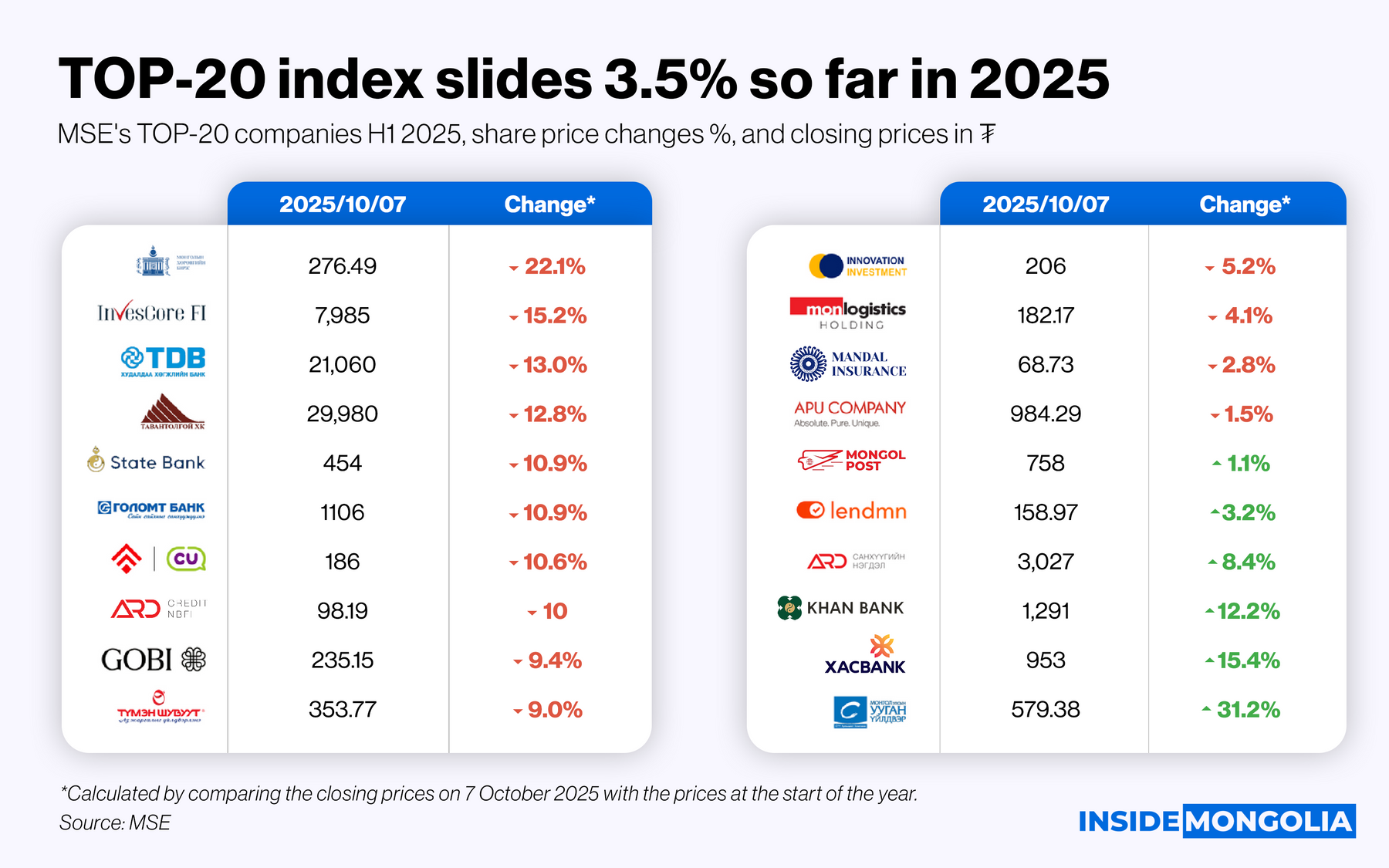

The TOP-20 index, reflecting the mood of Mongolia’s capital markets, has fallen 3.5% since the start of the year, reaching 49,676 points. Investors may be feeling that this autumn is a bit chillier than expected.

🥶 Decliners: 14 Companies

14 companies have led the market decline. The Mongolian Stock Exchange (MSE) has fallen 22.1%, with Invescore (INV) following at 15.2%. On average, the share prices of these 14 companies have dropped 9.8%.

- 💼 New Leadership: Last week, B.Khash-Erdene was appointed acting CEO of the MSE. Investor reaction was mixed. The company’s share price fell 4.6% to ₮276.5 following the announcement.

- 👋 Exiting Player: 2 months ago, Gobi (GOVI) announced its intention to delist from the MSE. The Financial Regulatory Commission opposed the move, but the company confirmed it would not reverse the decision. GOVI shares have fallen 9.4% year-to-date to ₮235.2.

🔥 Gainers: 6 Companies6 companies posted gains last week, led by Suu (SUU) with a 31.2% increase. XasBank (XAC) and Khan Bank (KHAN) followed with 15.4% and 12.2% gains, respectively. Notably, 4 of the 6 gainers are financial sector companies, signaling potential sector strength.

- ⚡ Sharp Rise: $XAC shares jumped 7.3% to ₮953.2 after the company announced ₮18 per share dividend payments from H1 profits and a ₮980 share buyback.

Overall… The TOP-20 companies are entering the colder months without fully benefiting from the earlier market momentum. How the index performs by year-end remains to be seen, will investors face a harsh winter in the market? 😬

Comment