Aspire Mining Reclaims Ovoot & Nuurstei Projects

Khulan M.

September 15, 2025

September 15, 2025

Aspire Mining (AKM.AX) is regaining full control of its Mongolian coking coal projects, clearing legacy agreements and seeing a major shareholder exit in a $13.5 million deal that strengthens the company’s position in Asia’s coal market.

📈 Exclusive Marketing Rights Secured

As a result, Aspire will now hold exclusive marketing rights for coal from its Ovoot and Nuurstei coking coal projects after agreements with Talaxis and related parties were restructured. Talaxis, which previously held more than 13% of Aspire’s shares, is selling its entire stake to NordSteppe Private Investment Fund, with the deal expected to close by March 2026. Under the new arrangement, Aspire will also reclaim a 20% stake in key infrastructure for just $1, while former partners waive future revenue claims. In return, Aspire will pay NordSteppe a 0.75% royalty on Ovoot coal sales.

- The restructuring lifted investor confidence, with Aspire shares up 13%, positioning the company to capture more profits amid strong Asian demand for Mongolian coking coal.

🛤️ Government-Backed Infrastructure Support

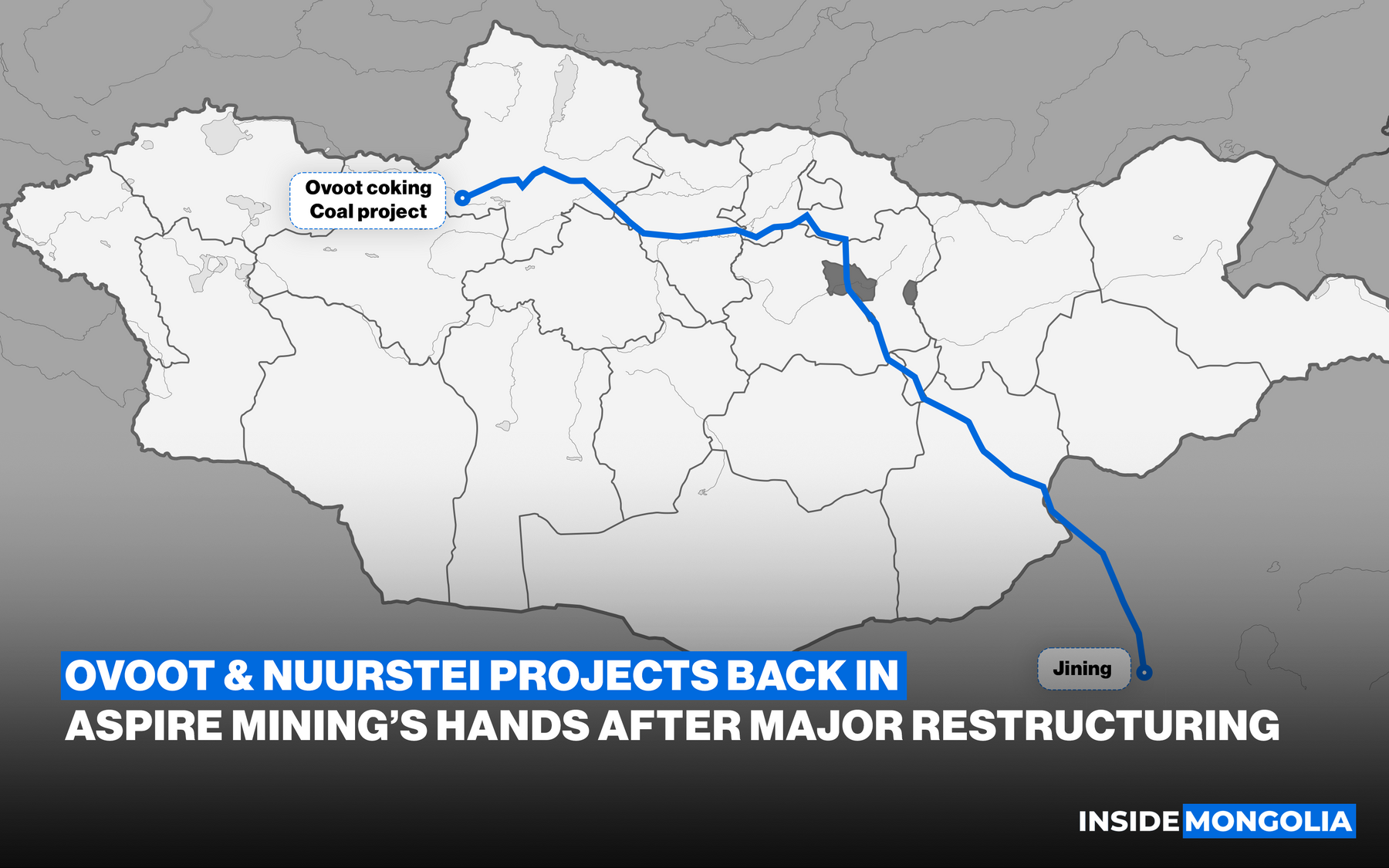

Aspire is set to benefit from government-backed infrastructure that could further de-risk its operations. The Mongolian government has agreed to construct the Murun-Uliastai Highway, intersecting with a haulage road connected to the Ovoot Coking Coal Project. Developed as part of a Public-Private Partnership Agreement, Aspire is the main private partner and is preparing to submit a bid for project execution. A tender agreement is expected within 6 months. This highway is critical for logistics, improving transportation efficiency, and potentially lowering capital expenditure.

- 👔 Strategic Leadership Change: Aspire also announced a leadership change, with D.Achit-Erdene appointed as Executive Chairman, succeeding Michael Avery, who remains on the board as a Non-Executive Director to advance the Ovoot Project.

Overall… Aspire Mining is solidifying its role as a top supplier of Mongolian coking coal. The Ovoot deposit, often called the “little brother” of Oyu Tolgoi, boasts 130 million tons of total reserves, 76.8 million proven and 53.3 million inferred, underscoring its world-class potential. With strategic control, strong infrastructure support, and growing demand in Asia, Aspire is well-positioned to turn this potential into lasting value.

Comment