The suspension of the Oyu Tolgoi project tax dispute expires on December 31st

Khulan M.

December 18, 2023

December 18, 2023

December marks the critical deadline for resolving the Oyu Tolgoi tax dispute. Meanwhile, the Mongolian Tax Authority recently issued a tax bill to Oyu Tolgoi. What is happening between the Government and Oyu Tolgoi?

Core issues

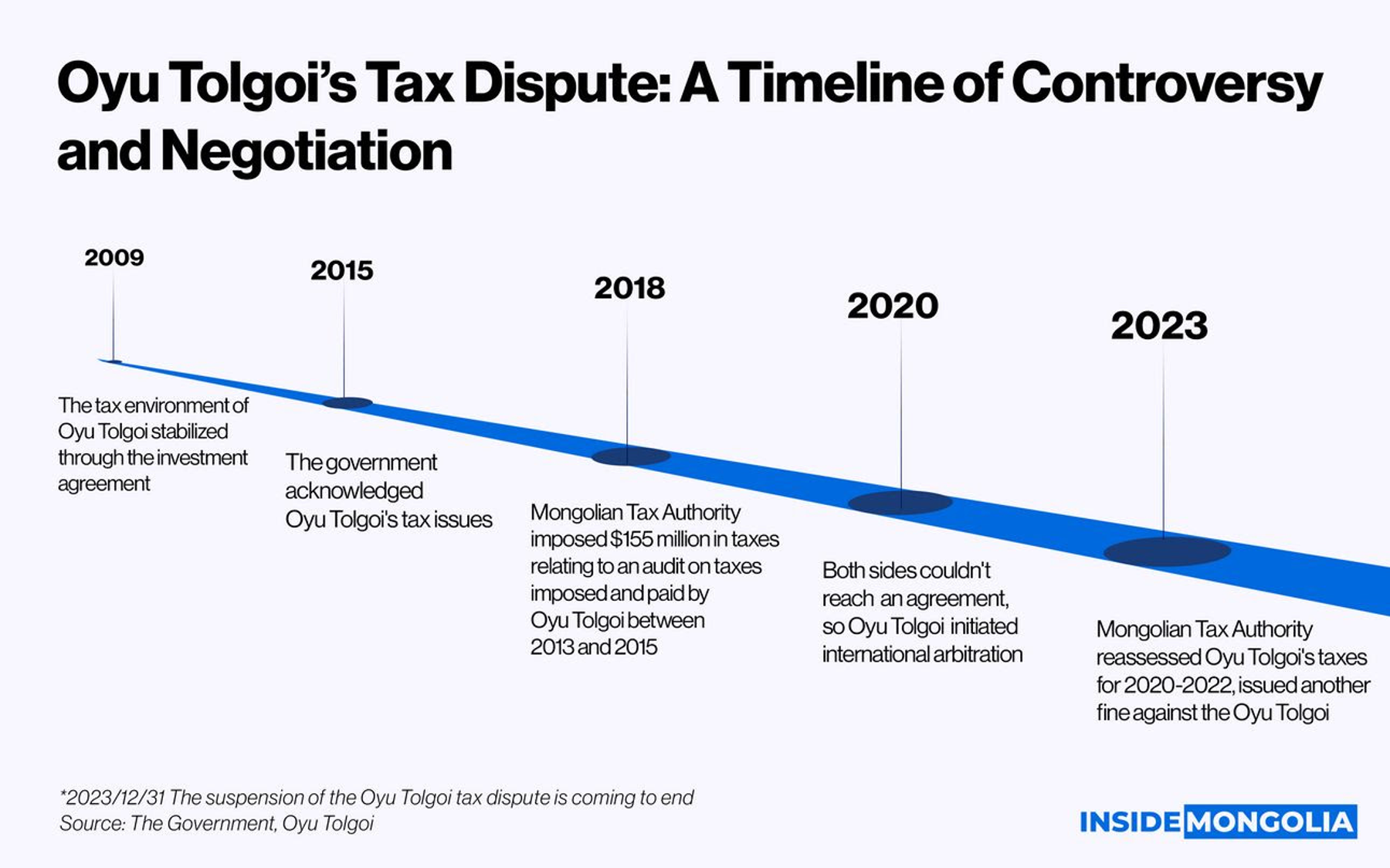

At the heart of the disagreement lies the interpretation of the 2009 Investment Agreement. While the agreement stabilizes specific tax rates for Business entity income tax, Mineral royalty, VAT, customs, and real estate at levels prevailing at the time, it remains ambiguous regarding overall tax environment stability.

- Rio Tinto (RIO), Oyu Tolgoi's head company, interprets this as guaranteeing immunity from any subsequent legislative changes affecting the project's taxation. Conversely, the government maintains the right to adjust tax rates as needed.

This clashing of interpretations led to a series of events:

- 2015: The Government of Mongolia temporarily accepted Rio Tinto's interpretation, seemingly resolving the dispute.

- 2018: Mongolian Tax Authority audited Oyu Tolgoi's operation during 2013-2015 and fined the company $155 million. The company partially complied or paid $4.8 billion but disputed the remaining amount.

- 2020: Since Oyu Tolgoi and the government could not resolve the tax dispute covering the years 2013-2015 for 2 years after 2018, Oyu Tolgoi submitted to the arbitration court.

- December 2020: The government believes the tax was reasonable, so they filed a counterclaim seeking an additional ₮649.4 billion in tax assessments. Now and again putting up a $70-$80 million bill.

Both parties have declared a preference for resolving the dispute through negotiation. Rio Tinto hopes to strengthen its relationship with the government, while Mongolia aims to secure its rightful tax revenue. However, the counterclaim complicates the situation, and the arbitrator's eventual decision holds significant weight. A ruling in favor of Oyu Tolgoi could nullify the disputed bills, impacting government finances and public sentiment.

Furthermore, during the COVID-19 pandemic, the Mongolian government disbursed ₮1 trillion in total, or ₮300,000 to every citizen from its shared bank account with Oyu Tolgoi. Additionally, with upcoming parliamentary elections on the horizon, the resolution of the tax dispute may become intertwined with political considerations. What will happen?

Comment