Mongolia 2025: Mapping the Capital Market Landscape

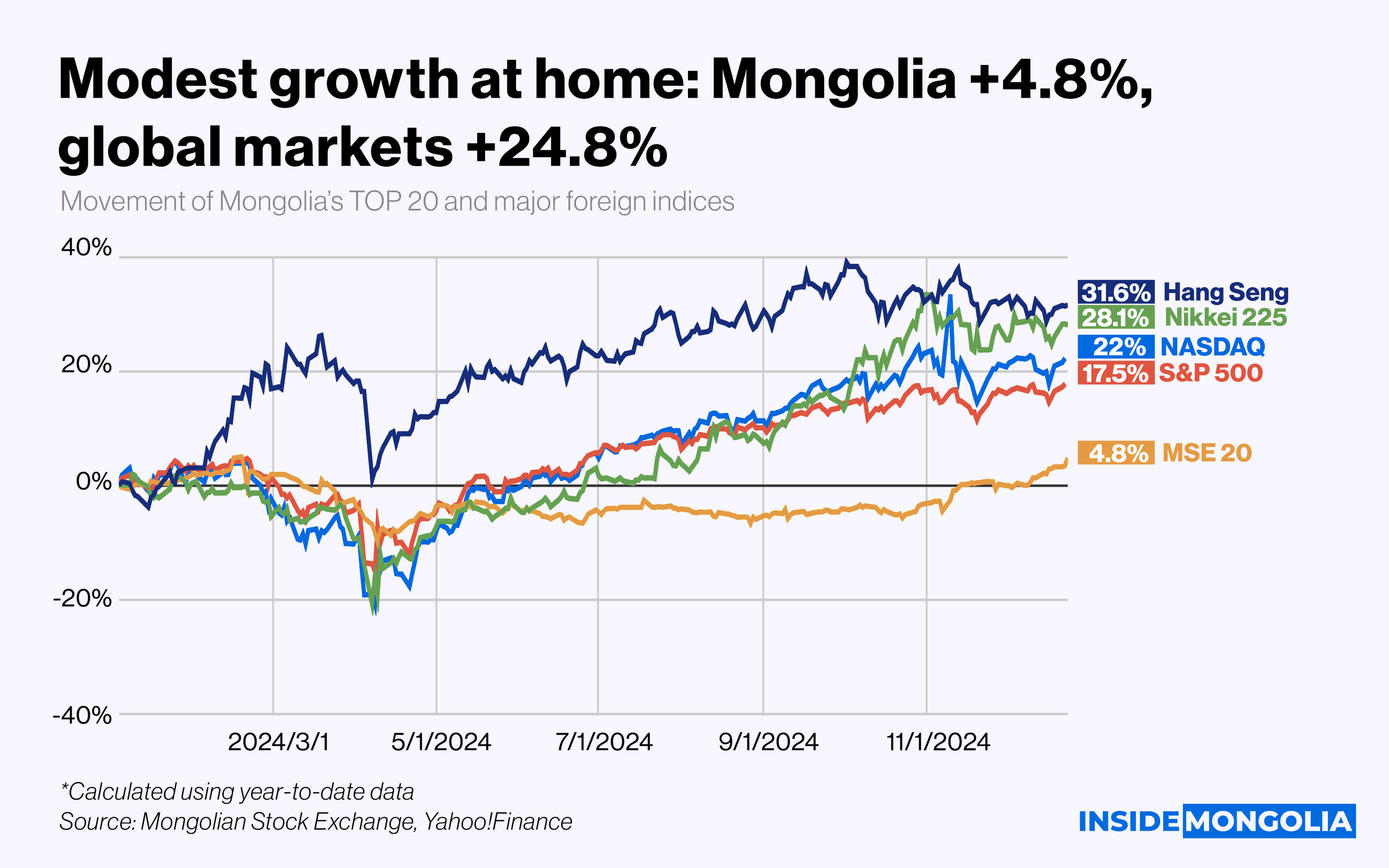

Today’s capital market wrap opens with major stock index movements. Global markets delivered mixed and generally subdued results, while Mongolia’s TOP-20 index recorded modest gains.

🔬 Let’s take a closer look

In 2025, driven by rapid technological advancement, the NASDAQ (^IXIC) rose 22% year-to-date, while the S&P 500 (^GSPC) gained 17.5%. The widespread adoption of AI, increased investment flows, and easing tariff tensions all played a key role in supporting US equity markets. In addition, the Federal Reserve cut interest rates three times, while semiconductor giant NVIDIA (NVDA) reached a market valuation of $5 trillion.

🌏 Asian Markets on the Move

Japan’s Nikkei 225 (^N225) climbed 28.1% in 2025 and surpassed 50,000 points for the first time in history on October 27. The rally was supported by improved corporate governance, the formation of a new government, yen stability, and rising AI-related demand. Meanwhile, Hong Kong’s Hang Seng Index (^HSI) advanced 31.6%, fueled by policy support from Beijing, strong performances by major technology firms, and a rebound in IPO activity.

- 🇲🇳 Modest Growth at Home: Compared with major global indices, Mongolia’s TOP-20 index recorded a relatively modest gain of 4.8% year-to-date. During the year, 4 new companies, all from the financial services sector, joined the TOP-20 index. In broader terms, total market capitalization increased by 6.8%, reaching ₮13.8 trillion as of yesterday.

🔀 Stocks That Rose and Fell

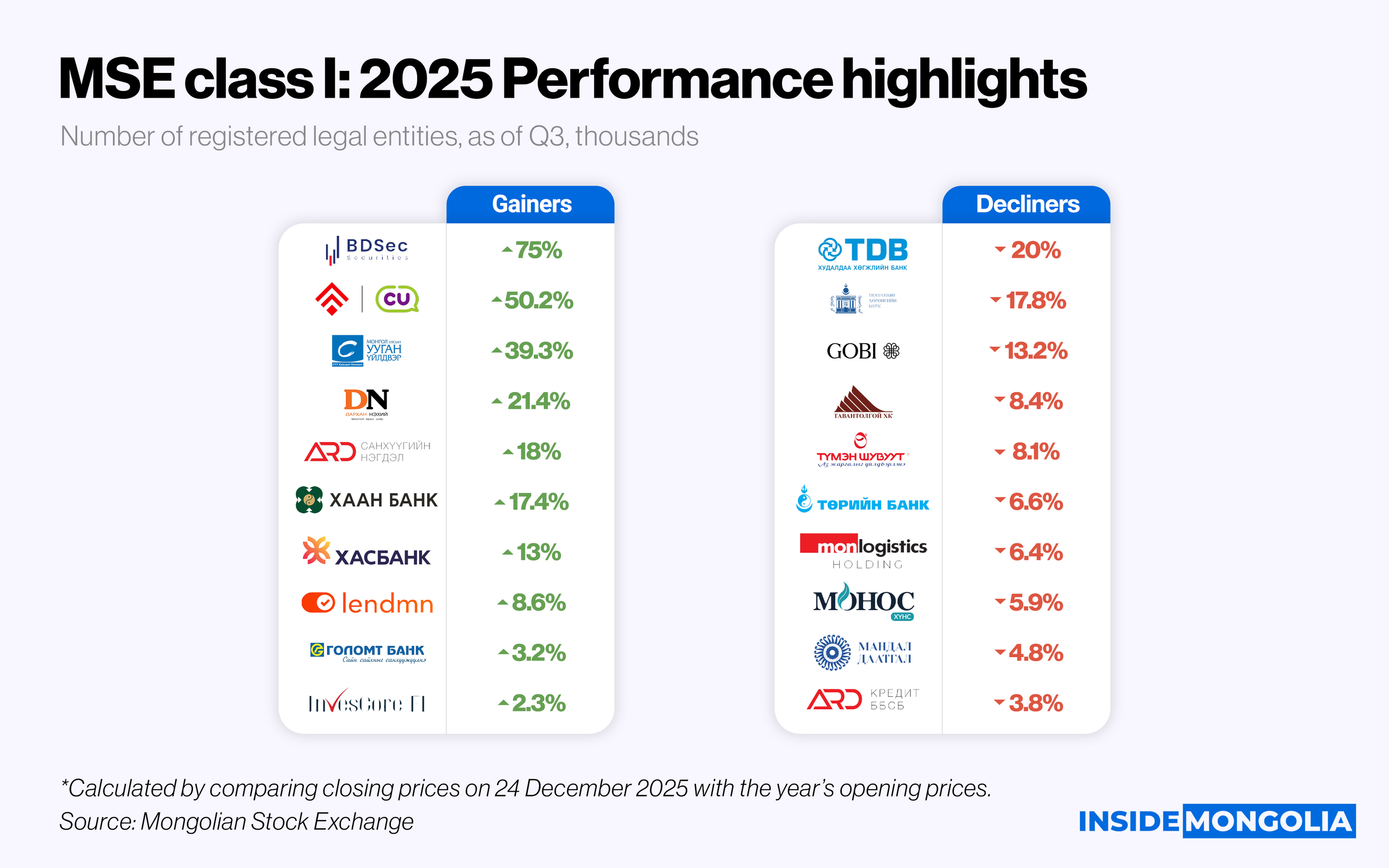

Turning to MSE Class I companies, 11 out of 25 posted share price gains in 2025, while the remaining 14 saw declines.

- ❤️🔥 Top performers: BDSec (BDS) led the market, with its share price surging 75% to ₮2,800. It was followed by Premium Nexus (CUMN), which rose 50.2%, granting shareholders the right to sell their shares. Notably, 3 of the top 4 gainers came from the non-financial sector.

- 🏦 Large banks: Shares of the 5 systemically important banks rose by an average of 1.4% in 2025. Khan Bank (KHAN) posted the strongest gain at 17.4%, while Trade and Development Bank (TDB) recorded the largest decline at 20%.

Among the top 10 gainers, 7 were financial companies, while the remaining 3 came from the food, light industry, and retail sectors. Falling coal prices weighed heavily on Tavan Tolgoi (TTL) and the Mongolian Stock Exchange. While their share prices fell by an average of 23.8% in the first half of the year, losses narrowed to 13.1% by year-end.

🔻 Trading Activity Slows

As of the first quarter of 2025, trading volume on the MSE fell 40.6% year-on-year to ₮144.9 billion. Secondary market liquidity declined by 0.7 percentage points to 1.1%, marking its lowest level since 2017. The number of repeat trading participants dropped 4.6% year-on-year to 91,200.

- 📍 In the spotlight: Tumen Shuvuut (TUM) recorded the largest increase in minority shareholders, adding approximately 4,000 investors in 2025. The company was also among the top three in this category last year.

🦄🛸 Foreign Investors: In Short Supply

Foreign investor participation continued to weaken. In 2025, just 0.8% of investors were foreign individuals, while foreign enterprises accounted for only 0.1%.

- 📌 Specifically, the share of foreign legal entities briefly rose to 3%–5% in January and March, before plunging to 0% by September. Unsurprisingly, markets without IPOs or meaningful liquidity struggle to attract attention.

- 🐐 Citizen power: By contrast, domestic retail participation strengthened toward year-end, accounting for 75.78% of total trading in November alone, driven largely by dividend expectations and corporate actions. The message is clear. The market urgently needs greater activity, deeper liquidity, and conditions that attract both domestic and foreign investors.

🗣️🙊 Scandal

While 2025 was broadly quiet for the stock market, several developments involving listed JSCs nonetheless stood out.

- 📢 Gobi JSC Controversy: While Gobi (GOV) remains a flagship example of Mongolian companies expanding abroad, it has also become one of the most controversial JSCs. The company attempted to convert into a closed entity, but regulators found legal violations and 6 consecutive years of losses, raising serious concerns over minority shareholder protection.

- 🧐 $CUMN’s Buyback Decision: Shareholders of Premium Nexus approved a proposal to buy back 75% of outstanding shares at ₮350 per share, a 75.2% premium over the 6-month weighted average price, offering a rare jolt of optimism to a dormant market.

- 📈 Revival of UBX: Between 2024 and 2025, trading volume on UBX surged to 13 times that of the previous 8 years combined. The number of listed securities rose 12-fold, member firms increased 16-fold, and ETF and bond trading expanded significantly, earning UBX the Grand Bull Award for Best Infrastructure Company.

- 🥵 OTC Fever: While exchange-listed bonds remain limited, the OTC market has flourished. Over 300 bonds from 150 issuers were issued in 4 years, generating ₮4.9 trillion in trading since September 2021. By Q3 2025, ₮920.6 billion was concentrated in NBFI, a 2.4-fold increase from 2022.

- Crypto Corner: After peaking in 2021, Mongolia’s crypto market has remained subdued. Still, Ardcoin (ARDX) saw a modest rebound, reaching ₮35 in September—its yearly high. Ard Financial Group (AARD) also announced plans to tokenize its common shares for trading on a virtual exchange.

‼️ Struggle and Growth

Trading of mining products gained momentum in the second half of the year. While only 5.3 million tons were traded on the Mining Products Exchange (MPE) in H1, volumes surged to 18.1 million tons in H2.

- 🥸 What changed? One contributing factor was the Government’s Resolution No. 55, issued in August, which requires exporters trading at least one-quarter of their exports on an exchange to calculate royalties based on exchange prices, boosting trading activity.

- ❤️🩹 Still, challenges remain: Despite higher exchange activity, coal prices continued to fall, weighing on mineral exports. In the first 10 months of 2025, mineral exports totaled $11.5 billion, down 7.1% year-on-year.

The market remains full of surprises… Waiting for the right day, the right month, and deciphering numbers that often confuse more than they clarify. Mongolia’s capital market is evolving, but faster growth will require policy incentives, scalability, and deeper liquidity. What happens once underperforming public companies are fully exposed to market discipline?

Comment