Dividend Distribution Train Rallies

Khulan M.

February 17, 2025

February 17, 2025

The trend of companies distributing dividends gains momentum as the year progresses.

💸 Current Status: 10 Companies Announce Dividends

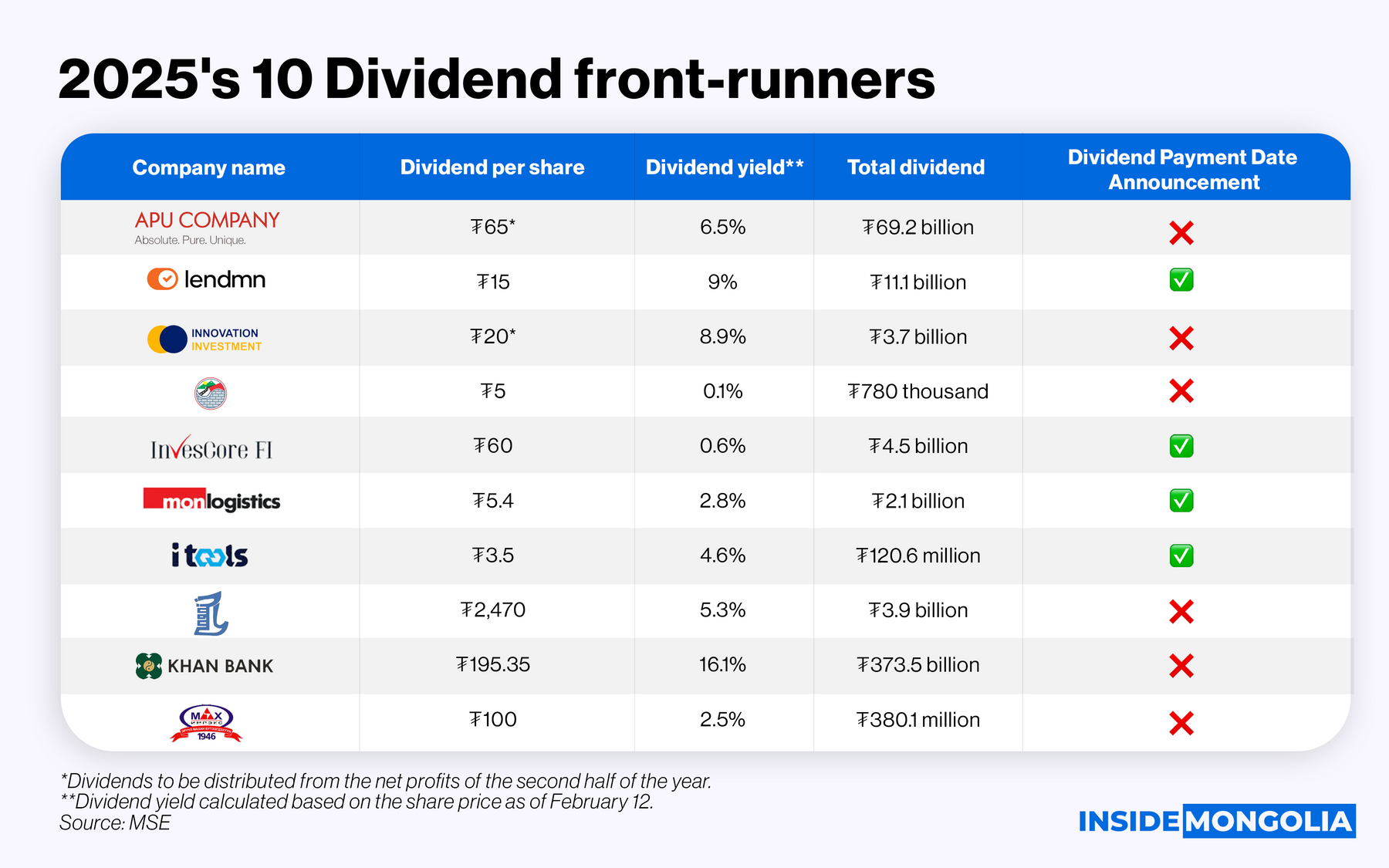

Since the start of the year, 10 public companies announce dividend distributions. Among these, KhanBank (KHAN) and APU (APU) stand out with the highest dividend payouts. For instance, KhanBank distributes 58.5% of its 2024 net profit, amounting to ₮373.5 billion, as a dividend of ₮195.35 per share, yielding a solid 16.1%.

- 🦄 Meanwhile, APU decides to distribute ₮69.2 billion from its second-half 2024 net profit, contributing to a total of ₮127.6 billion in dividends for the year. Based on last Thursday's share price, their second-half dividend yield stands at 6.5%.

- 🏁 Dividend Yield Rankings: At the other end of the spectrum, Erdenet Suvraga (SVR) and Invescor NBFI (INV) offer the lowest dividend yields, while LendMN NBFI (LEND) stands out with the highest dividend yield among NBFIs.

🤔 Stock Price Reactions

Investors react positively to dividend announcements. Following KhanBank’s dividend announcement, its share price rises 9.6%, and Invescor NBSF’s share price rises by 4.62% the day after the announcement. Additionally, Monlogistics Holding (MLG), which announces both a dividend and a share buyback, sees a notable increase in its share price of 8.38%.

👍🏻 Setting a Standard for Transparency

It’s good news for investors as 4 out of the 9 companies disclose their dividend payment dates clearly. LendMN NBSF, for the second year in a row, confirms its dividend payout date of April 4. Such transparency benefits investors, allowing them to plan and manage their dividend yield expectations effectively.

🙅🏻 No Dividends for Some Companies

However, 6 companies opt not to pay dividends. Gobi (GOV), which had initially planned to distribute dividends in 2024, reverses this decision, citing that its financial results do not meet the conditions necessary for dividend payments. For some companies, particularly those dealing with losses, and debts, or focused on expanding operations, not paying dividends is a strategic move to reinvest profits into growth.

Finally, investors are still awaiting decisions from the banks. Once those are made, we analyze the companies that raise expectations and provide updates accordingly. Stay tuned for more insights!

Comment