Mongolia’s OTC Bond Market Surged to ₮1.7 Trillion in 2024

Khulan M.

May 5, 2025

May 5, 2025

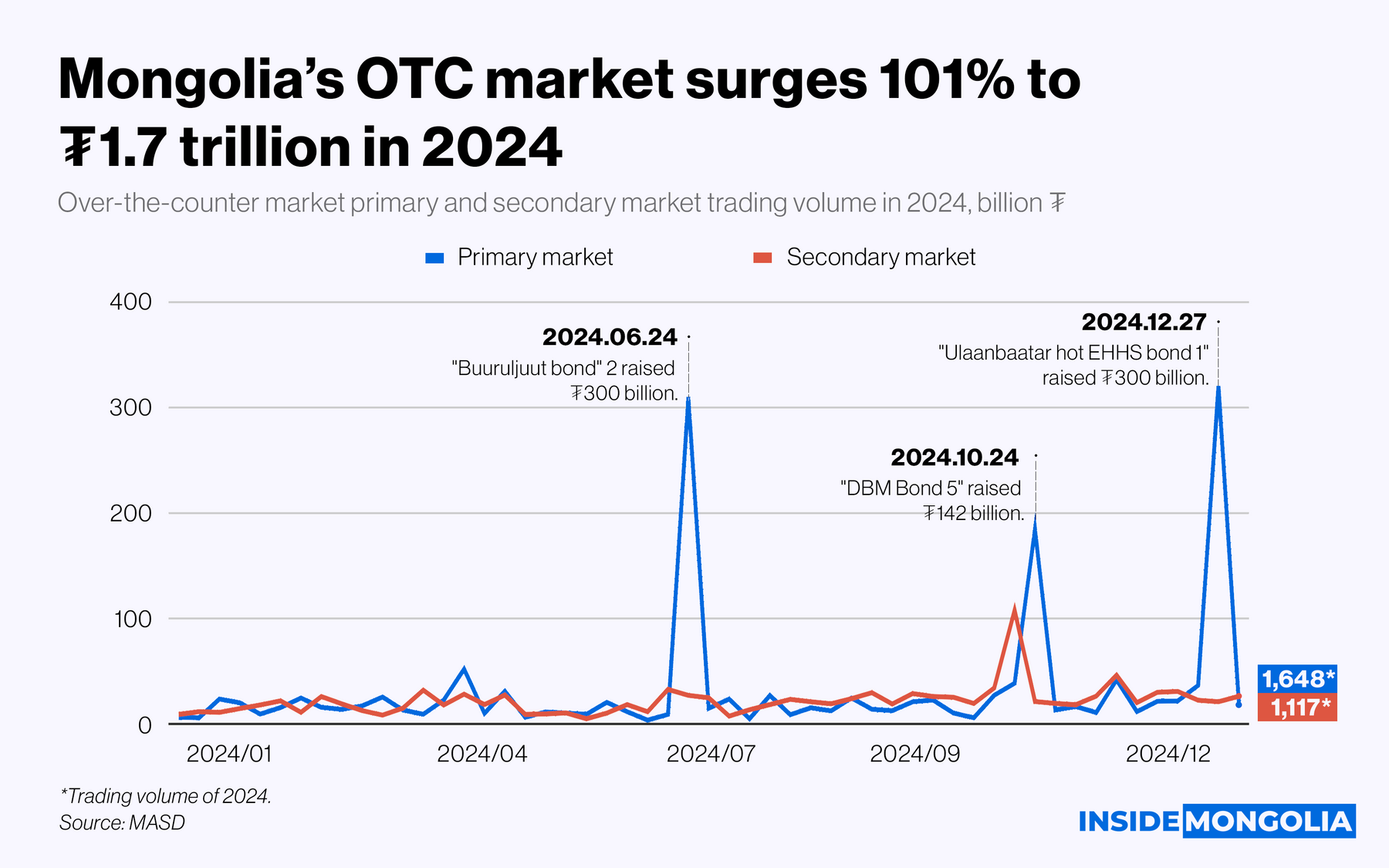

Mongolia’s Over-the-Counter (OTC) bond market surged to ₮1.7 trillion in 2024, marking significant growth despite a decline in the number of bond offerings.

🖼️ The Big Picture

A total of 131 bonds were traded, down 33% from the previous year. Dollar-denominated bonds also saw a sharp increase, with $71.9 million raised, up 115% year-on-year. The number of active issuers climbed by 51% to 95, indicating a broader participation base and growing confidence in the OTC market.

🌠 Trading Snapshot

- ₮ Bonds: The primary market saw a total of ₮1.6 trillion traded in 2024, averaging ₮31.1 billion in weekly volume, while the secondary market recorded a weekly average of ₮21.1 billion. Among the most actively traded were “Buuruljuult Power Plant Bond 2” and “Ulaanbaatar City EHHS Bond 1,” particularly active in June and December.

- $ Bonds: In 2024, the primary market for U.S. dollar-denominated bonds raised $69.8 million, averaging $5 million in weekly trading. Secondary market activity totaled $12.7 million, with trading concentrated over just 20 weeks, compared to year-round activity for MNT-denominated bonds, which were traded consistently across all 52 weeks.

🗺️ Bond Landscape

- By Sector: Financial institutions dominated the market, accounting for 46.9% of all issuances, followed by the energy sector at 38.4%. Among the financial sectors, the leading issuers of bonds are the NBFIs.

- By Maturity: In terms of maturity, 59% of all bonds issued in 2024 had a term of 3 to 12 months, making it the most preferred structure. This was followed by 18-month bonds at 24%, 24-month bonds at 13%, and only 4% with maturities of 36 months+.

Overall… Over the past 4 years, Mongolia’s OTC market has emerged as a dynamic financing platform, unlocking capital for non-bank financial institutions and offering attractive returns for investors. While the market itself can’t be awarded, its contribution to financial sector development is undoubtedly deserving of recognition.

Comment