Mongolia 2025: Mapping the Business Landscape

Khulan M.

December 30, 2025

December 30, 2025

📊 New and Discontinued Businesses

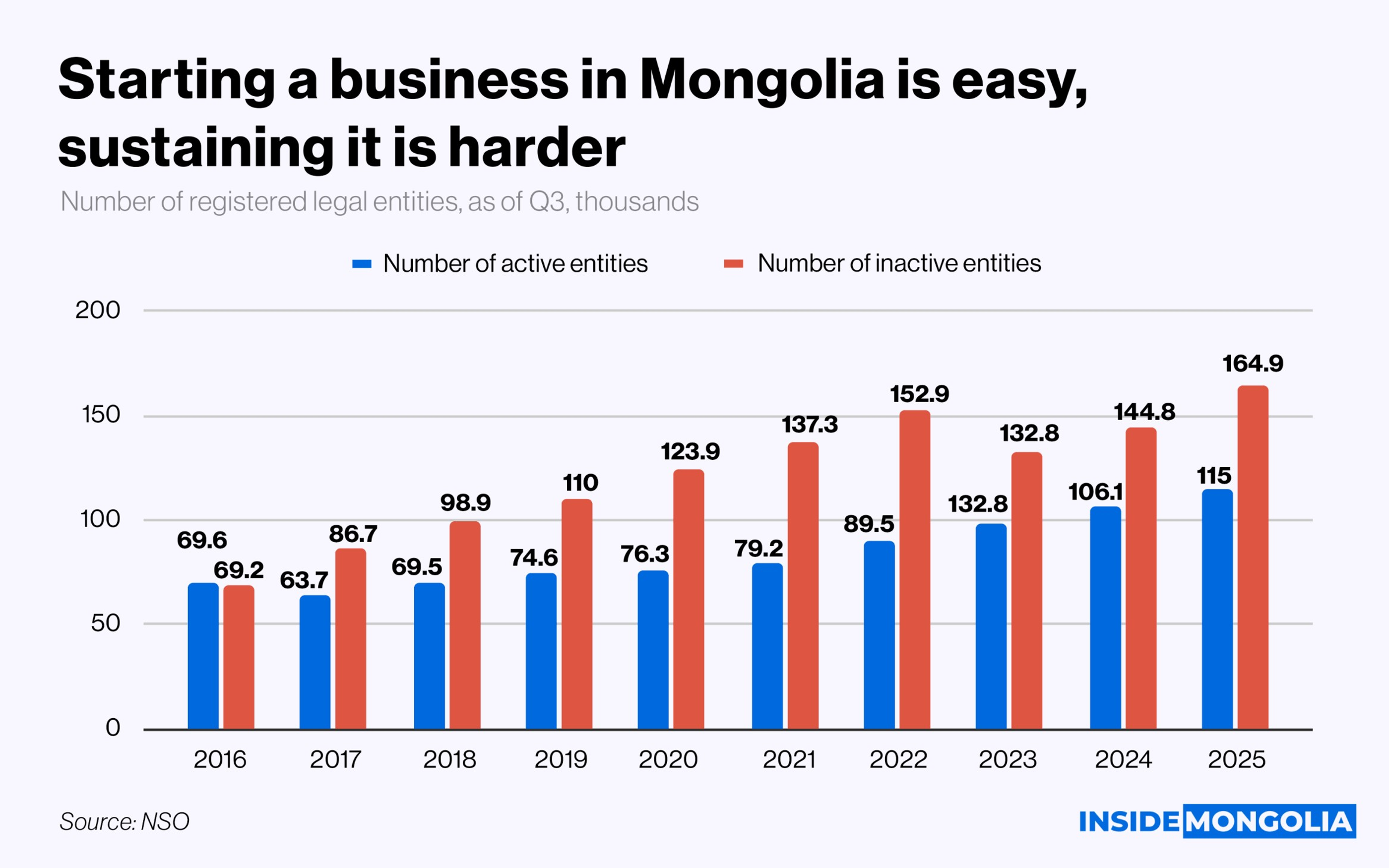

In the third quarter of 2025, the number of operating entities rose by 8.5% year-on-year, reaching 115,000, while the number of inactive entities increased by 13.9%, climbing to 164,900. A decade-long view highlights a structural imbalance, with inactive entities expanding at double the rate of active businesses.

- ⌛️ A decade in perspective: In 2016, the number of operating and inactive entities was nearly equal. By 2025, however, inactive entities had increased 2.4 times, accounting for 58.9% of all registered businesses. While this can partly be attributed to market competition, the accelerating difficulty of doing business in Mongolia remains a key driver behind widespread business closures.

🛡️ Protecting the Private Sector

On December 22, the Draft Law on Economic Freedom was submitted to Parliament. For a country consistently struggling with economic freedom indicators, this legislation could offer meaningful relief to the private sector. The draft law enshrines the principle that private economic activity is permitted unless explicitly prohibited by law, while banning unlawful inspections, property seizures, and interference by state institutions and officials.

🥀 Tax Revenue Under Pressure

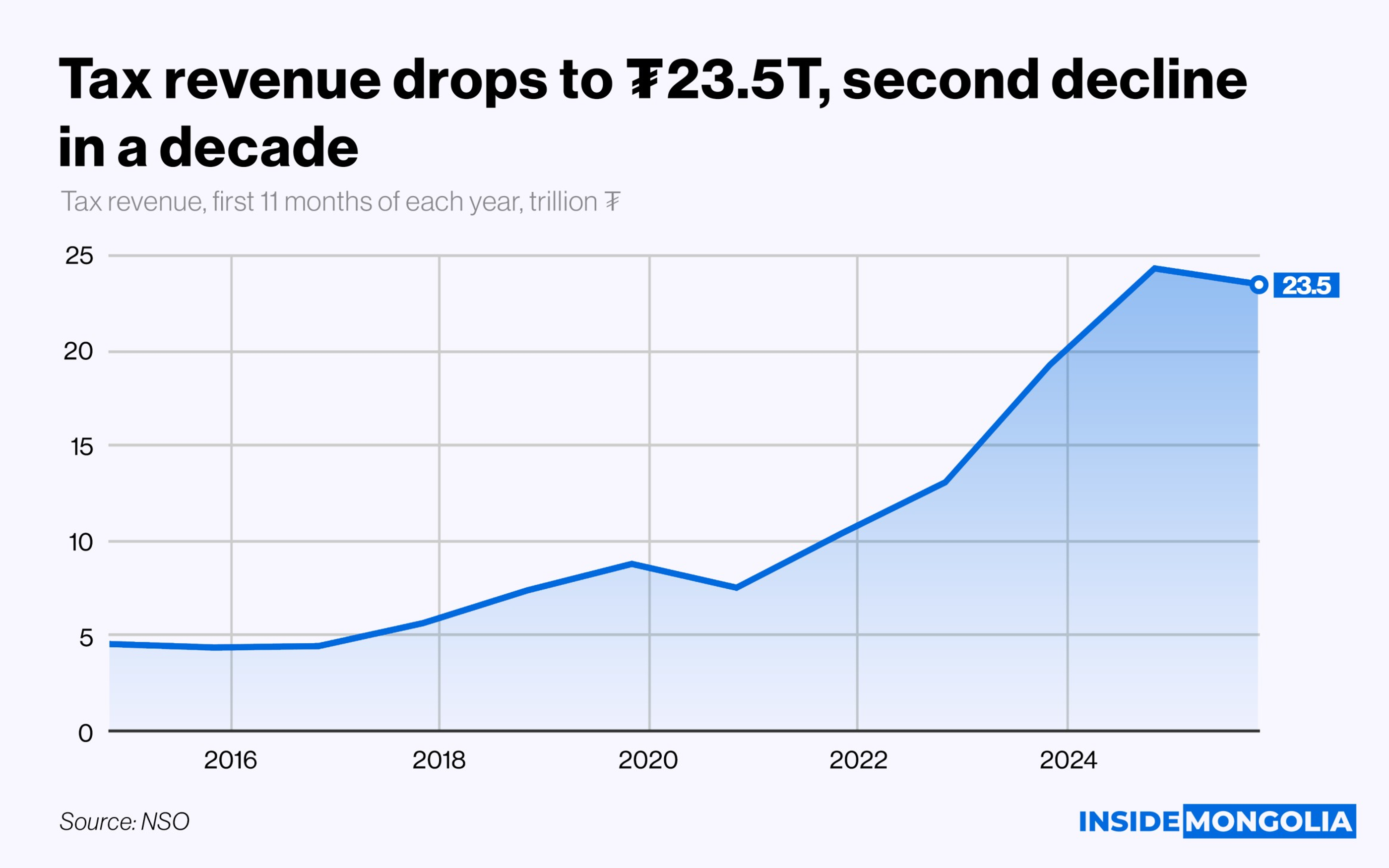

During the first 11 months of 2025, Mongolia collected ₮23.5 trillion in tax revenue, representing a 3.4% decrease from the same period last year. The decline reflects falling coal prices and mounting difficulties faced by businesses in meeting tax obligations. According to the General Department of Taxation, the government planned to collect ₮17.9 trillion under the 2025 state budget but has so far secured only ₮15.5 trillion, or 86% of the target.

- 😓 Where is the money? To offset revenue shortfalls, tax authorities intensified the collection of accumulated tax arrears, resorting to measures such as account freezes and asset seizures. These actions affected approximately 72,000 businesses, turning tax enforcement into a growing operational risk for the private sector.

⏭️ Tax Package Law

Amendments to the Tax Package Law, expected to take effect next year, are scheduled to be submitted to Parliament this year. Developed over the past year, the amendments represent the fourth major tax reform since 1990. If approved, 9–10 out of the 30 existing tax types will see changes in rates and parameters. As a result, state tax revenue would decrease by ₮2.8 trillion, effectively leaving that amount in the hands of citizens and businesses.

💰 Securities as a Source of Financing

Policy stability, regulatory certainty, and access to finance remain among the most pressing challenges for businesses operating in Mongolia. In response, companies have increasingly diversified their funding sources. In 2025, a growing number of firms issued bonds and asset-backed securities in the domestic market to support expansion. Approximately 150 securities were traded across the Mongolian Stock Exchange (MSE), Ulaanbaatar Stock Exchange (UBX), and the Over-the-Counter (OTC) market, raising a combined ₮1.8 trillion.

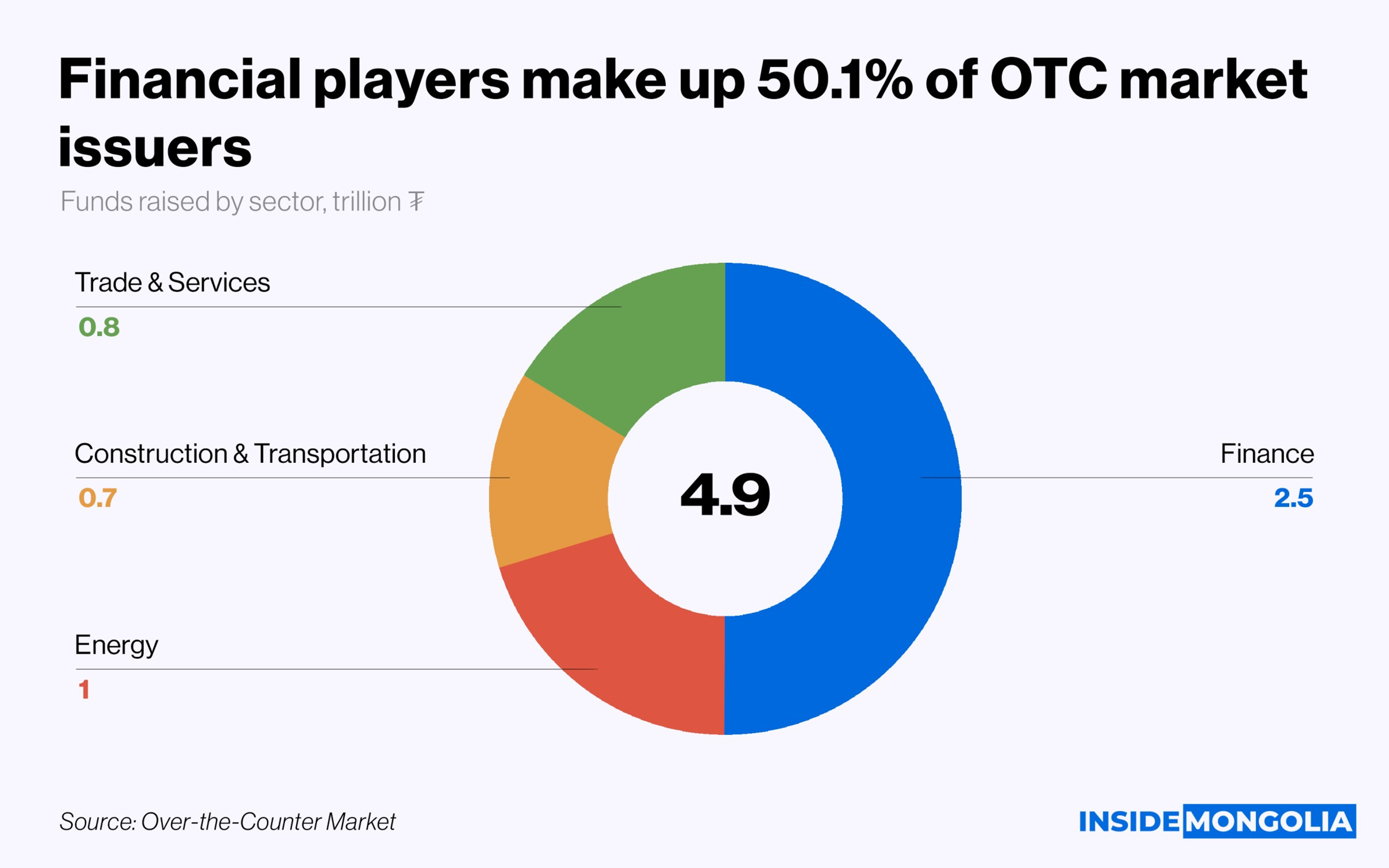

- 📷 Big picture: Historically, companies issuing securities through the OTC market have raised a total of ₮4.9 trillion, with 50.1% originating from the financial sector. Within that segment, non-bank financial institutions accounted for 51.4%, or ₮1.3 trillion.

💡 TOP-100 Break into Capital Markets

The Financial Regulatory Commission (FRC) and the Mongolian National Chamber of Commerce and Industry (MNCCI) jointly launched the “Attracting TOP-100 Enterprises to the Capital Market” program. Under the initiative, TOP-100 companies are eligible to issue financing instruments of up to ₮5 billion with a one-year maturity, through both public and private offerings. In 2025, the program was implemented by Shunkhlai Group and SUU Group.

⭐️ Star Startups of 2025

Mongolian startups delivered a strong performance in 2025, with local founders earning international recognition almost every month. From this growing ecosystem, we highlight 3 standout startups:

- Egune AI: In May, Egune AI raised $3.5 million from Golomt Bank (GLMT), becoming Mongolia’s most valuable tech startup with a valuation of approximately $40 million.

- Prohost AI: In October, Prohost AI, the first Mongolian-founded startup to enter Y Combinator, raised $2.6 million. Selected for Y Combinator’s Summer 2024 cohort, the company now serves nine multinational clients and generates $1.5 million in annual revenue.

- oneplace.hr: The AI-based HR solutions provider recently partnered with Hambi, a major Uzbek app with 5 million users, and secured $50,000 from IT Park Ventures of Uzbekistan, bringing its valuation to ₮10 billion.

Finally… This brings our 2025 business review to a close. Thank you for reading Inside Mongolia. See you in 2026! Adios! 👋📈

Comment