Mongolian Public NBFIs Thrive in 2024

Khulan M.

February 23, 2025

February 23, 2025

As the year-end earnings season comes to a close, a clearer picture of Mongolia’s publicly listed non-bank financial institutions (NBFIs) emerges. The sector experiences notable expansion, driven by rising demand for financial services and increased lending activity.

🤑 More Borrowers, More Loans

Mongolia currently has 573 NBFIs in operation, reflecting an increase of 60 since 2022. These companies now serve a combined 5.4 million customers, up 18.9% from the previous year. Consequently, net loan volumes surge by 80% to ₮5.7 trillion, underscoring the sector’s significant expansion.

🍰 Public NBFIs: 20% of the Sector

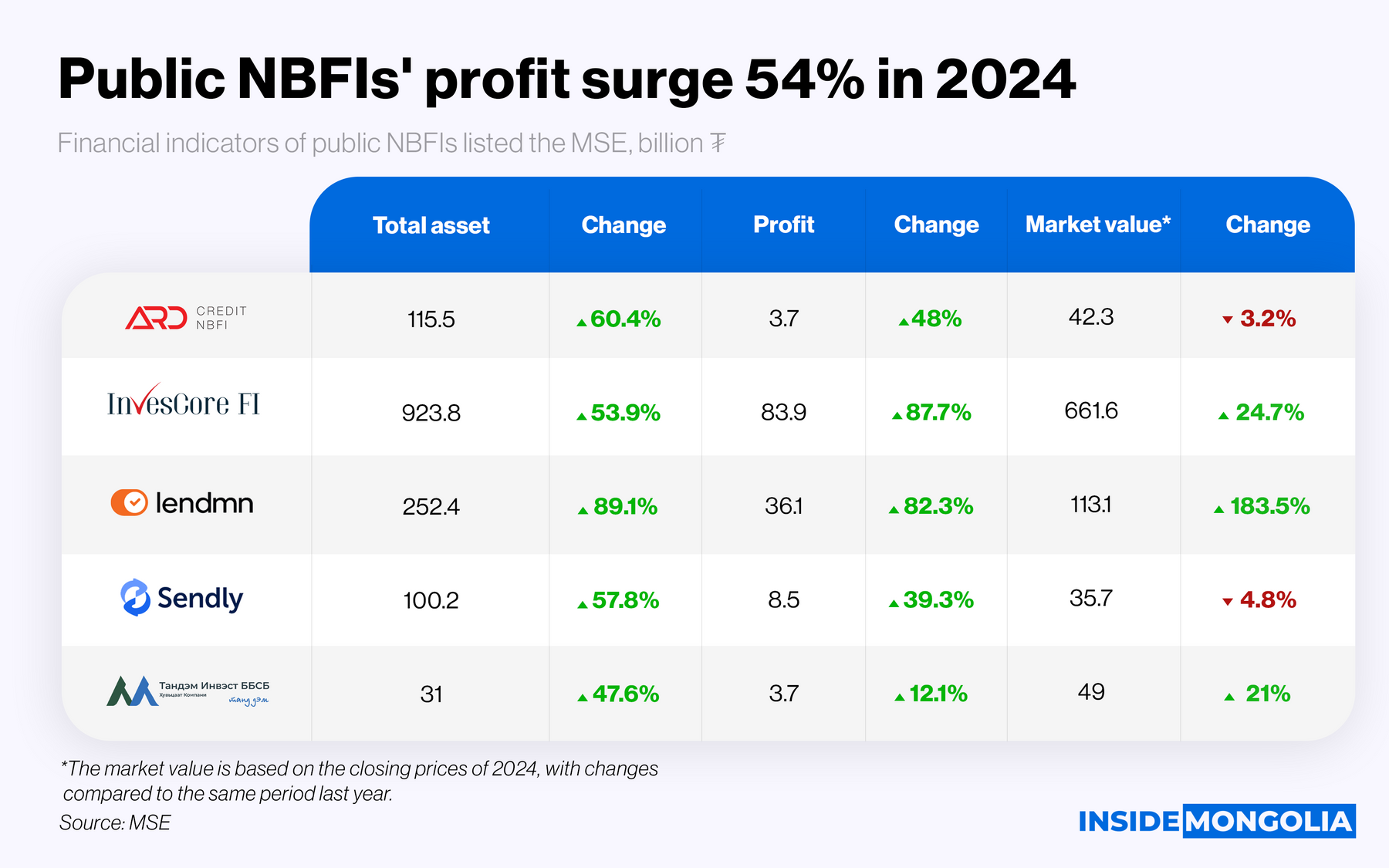

Despite the large number of NBFIs, only 5 have gone public through IPOs. These listed entities see their total assets grow by an average of 61.8% in 2024, reaching ₮1.4 trillion and accounting for 19.7% of the sector’s total assets. Their net profit rises by an average of 54% to ₮135.9 billion, driven by increased interest income and a growing customer base.

- 💫 Funding and Capital Markets: NBFIs play a crucial role in Mongolia’s financial sector, attracting substantial funding. They account for 81.1% of all bonds issued in the financial sector. Additionally, 3 of the 10 open bonds on the Mongolian Stock Exchange (MSE) come from NBFIs.

📊 Market Performance: Ups and Downs

Among the five publicly listed NBFIs, 3 experience market value growth in 2024, while 2 decline. LendMN NBFI (LEND), which records the highest total asset growth, sees its market value soar by 183.5%, while Sendley NBFI (SEND) registers the largest decline at 4.8%.

- 💸 Dividend Distribution: 4 out of 5 listed NBFIs, excluding Ard Credit (ADB), declare a total of ₮19.5 billion in dividends from their 2024 net profits. The average dividend yield stands at 4.9%, based on each stock’s closing price at the end of the year.

Looking ahead… Mongolia’s NBFI sector continues to expand, shaped by evolving consumer financial needs and economic conditions. Recently, Investcor NBFI (INV) secured a listing on the London Stock Exchange, joining a select group of Mongolian financial institutions with an international market presence.

Comment