MSE’s Latest Risers and Shifts

Khulan M.

September 8, 2025

September 8, 2025

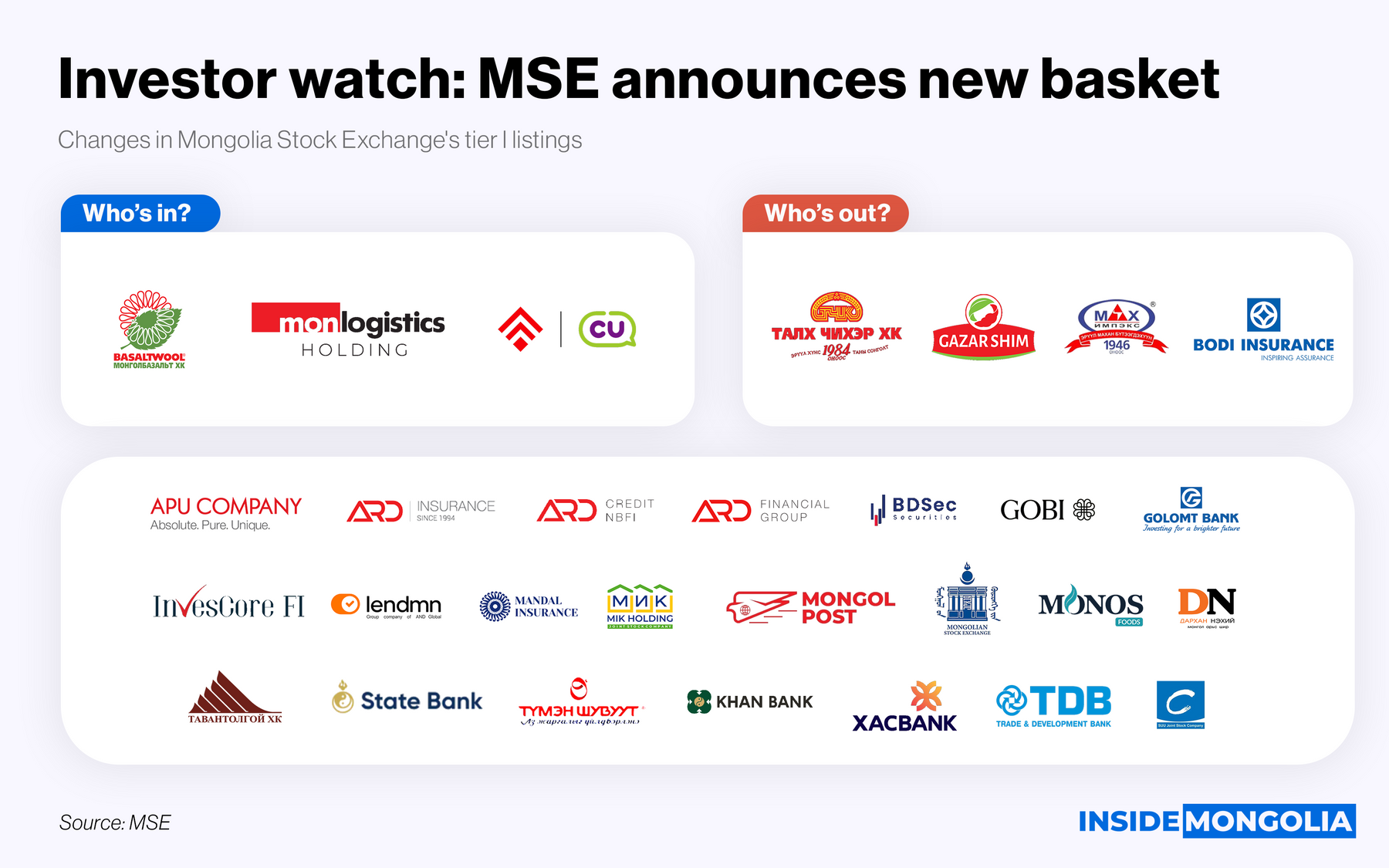

The Mongolian Stock Exchange (MSE) has released its latest securities classification update, reshuffling listed companies across tiers to reflect their current market standing.

🗣️ Who’s Rising and Who’s Falling?

The update sees Mongol Basalt (MWB), Monlogistics Holding (MLG), and Premium Nexus (CUMN) move up from Tier II to Tier I, underlining their strengthened market positions. Conversely, Talkh Chikher (TCK), Gazar Shim Uildver (GAZR), Makh Impex (MMX), and Bodi Insurance (BODI) have been downgraded from Tier I to Tier II.

- ➕ Additionally, Buligaar (MBG) advances from Tier III to Tier II, while Dornod Trade (DES), Erdenes Solutions (AMT), Mongol Shiltgeen (MSH), Aduun chuluun (ADL), Neheesgui Edlel (NXE), Berkh Uul (BEU), and Frontier Land Group (MDR) move from Tier II to Tier III, reflecting varied performance across sectors.

📝 Methodology Behind the Classification

The MSE classifies companies based on 2024–2025 metrics, market capitalization, profitability, and compliance, offering investors a clear view of financial strength and growth potential. Class I companies meet these strict standards. The financial sector leads with 48% market share, while manufacturing, agriculture, and others hold 20% each, and logistics and services hold 12%, highlighting their strategic role in market infrastructure.

🤔 Market Implications

These promotions and demotions highlight shifts in financial performance and market activity. Companies like Mongol Basalt and Monlogistics Holding are emerging as market leaders, while others face challenges maintaining top-tier status. For investors, these changes provide signals for portfolio rebalancing, emerging opportunities, and areas requiring cautious monitoring in Mongolia’s capital market.

Comment